Abraham Walker here, your local real estate expert, bringing you important information on the latest tax assessments in Fairfax County. Between 2024 and 2025, homeowners could see a nearly $1000 increase in their real estate tax bill. Keep reading to see how.

Real Estate Tax Rate Adjustments

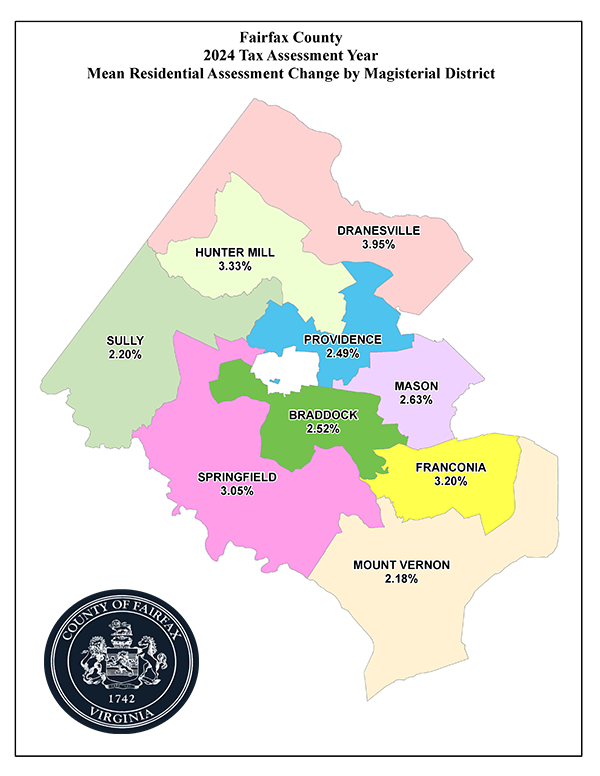

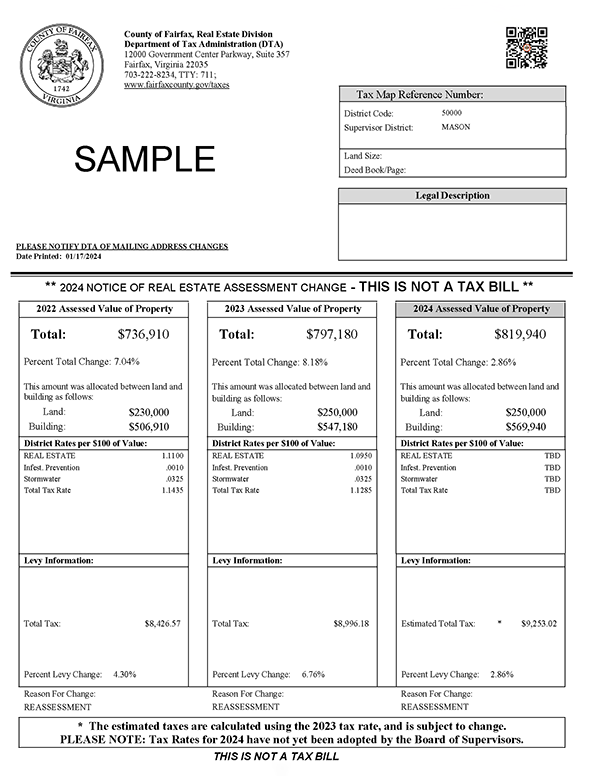

This year, there’s a slight decrease in the real estate tax rate, now at $1.095 for every $100 of your property’s assessed value. Despite this, you might notice an increase in your tax bill, with an average rise of $412. This uptick is due to the overall increase in home values across the county. In fact, the average value of a home in our area now stands at $744,526, which is a noticeable climb from last year’s $723,825. This increment, about 2.86% on average, comes amidst a slower residential market influenced by higher mortgage rates.

A Closer Look at Property Values

Out of over 357,000 residential properties in Fairfax County, an astonishing 73.03% saw an increase in value, whereas only 14.21% experienced a decrease. The value remained the same for 12.76% of properties. Here’s how different types of homes fared:

- Single-family detached homes: Now average $902,670, marking a 2.79% increase.

- Townhouses and duplexes: The average value here is $551,511, up by 2.99%.

- Condominiums: These saw the highest growth rate at 4.21%, with an average value of $351,552.

It’s important to note that these tax estimates are based on the new assessments and last year’s tax rates, as the Fairfax County Board of Supervisors hasn’t set the 2024 rates yet.

Looking Ahead: Proposed Tax Increase for 2025

The County Executive, Bryan Hill, is proposing a 4-cent increase in the real estate tax rate for the fiscal year starting July 1, 2025. This change would set the tax rate at $1.135 per $100 of assessed value, potentially raising the average tax bill by approximately $524. This increase will generate an additional $129.28 million in revenue and be the first hike in six years. Combined with the $412 average increase in 2024 due to escalating home values, homeowners, on average, could see a $936 increase in taxes over a two-year period.

Commercial Real Estate Woes

While residential values are climbing, commercial properties are seeing a more modest increase, with an average growth of just 0.54%. The office market, in particular, is facing challenges, including higher vacancies and financial difficulties, leading to a notable drop in office property values. This affects the county budget as in-office elevator properties represent 26% of the non-residential tax base. At the moment, the county’s office vacancy rate sits at 17.2 percent.

Understanding Your Tax Assessment

Remember, the assessment notice you receive is not a bill. For most homeowners, real estate taxes are part of their monthly mortgage payments and are handled directly by their mortgage company. If you’re unsure about how your taxes are paid, it’s a good idea to check with them. The key dates for those who pay directly are July 28 and December 5.

How to Appeal Your Assessment

If you feel your property’s assessed value doesn’t reflect its true market value, is inconsistent with similar properties, or contains errors in description, you might consider appealing. It’s important to remember that a general increase in value isn’t grounds for a successful appeal.

Appeals must be received by April 1st. You can download appeal applications here.

Real estate appeals can also be filed with the Board of Equalization (BOE). The BOE conducts formal hearings and considers sworn testimony. BOE appeal forms are available online or by calling the BOE office at 703-324-4891, TTY 711.

In Closing

As we navigate through the shifting landscape of real estate taxes in Fairfax County for 2024-2025, it’s crucial to stay informed and prepared. Whether these changes have you considering selling your current home to find something that better fits your financial future or you’re looking to buy in this dynamic market, expert guidance can make all the difference.

Thinking about buying or selling a home? Don’t navigate these waters alone. Contact me today, and let’s turn these changes into opportunities for you. Feel free to text me at 703-539-2053 or Click Here to schedule a time to meet virtually.